Outsmarting fraud in real-time: How Redis powers intelligent fraud detection

Fraudsters don’t wait—and neither can your systems.

Financial crime is faster, smarter, and more coordinated than ever. Every delayed response is a potential breach, a lost customer, or a reputational hit. Winning this game takes more than rules and reports—it takes real-time intelligence at massive scale

Financial institutions are fighting back with real-time, intelligent fraud detection. That’s where Redis makes the difference.

Redis powers the intelligent, always-on fraud detection systems that banks and payment processors need to stay a step ahead. With unmatched speed, real-time ML support, and a scalable in-memory architecture, Redis enables financial institutions to detect fraud as it happens—not after it hits.

The high-stakes cat-and-mouse game of fraud detection

Financial fraud is everywhere—and expensive. According to Nasdaq’s 2024 Global Financial Crime Report, scams and bank-related fraud resulted in $485.6 billion in losses worldwide in 2023.

Juniper Research projects that online payment fraud alone will cost merchants $91 billion by 2028—part of a cumulative $362 billion in losses expected between 2023 and 2028. That translates to nearly $25 billion per year on average—a clear signal that current defenses are no longer enough.

These numbers reflect more than just losses. They mean broken trust, frustrated users, and mounting pressure to catch fraud before it happens.

Fraud detection is more critical, and more complex, than ever. Technology teams at these institutions face the challenging task of:

- Spotting anomalies and suspicious behavior as they happen

- Adapting to evolving attack patterns—often in real time

- Scaling to support massive transaction volumes

- Maintaining sub-millisecond response times

- And ultimately, protecting revenue and customer trust

Legacy fraud tools are falling behind. Static rules miss nuance, batch processing is too slow, and database lag gives fraudsters a head start.

What leading institutions are doing differently

To stay ahead, financial organizations are rethinking fraud detection as a real-time data problem. They're moving beyond reactive defenses and building platforms that can make smarter decisions—faster.

The goal: Stop fraud before it strikes. That means:

- Identifying abnormal behavior in real time, based on customer history and intent

- Feeding machine learning models with up-to-date behavioral data

- Monitoring sessions for signs of takeover or bot activity

- Flagging duplicate or unusual patterns across massive datasets

- Doing all of this without slowing down legitimate users or denying legitimate transactions

And increasingly, they’re turning to Redis to make it happen.

How Redis supports modern fraud detection

Redis delivers the speed and flexibility to power intelligent fraud detection—at scale and in real time. Here’s how Redis is helping institutions transform fraud prevention into a real-time capability:

Real-time vector search to catch subtle fraud signals

With Redis’ native support for vector search, fraud systems can detect behaviors that look suspicious—based on what’s happened before. By comparing a new transaction to past activity using ML-generated embeddings, teams can catch risky behavior that rules alone would miss.

Redis makes it easy to embed vector similarity into fraud workflows—scoring users, devices, and transactions in real time using hundreds of behavioral signals.

Feature stores that detect fraud in real time with live data

Modern fraud detection is increasingly ML-driven—but models are only as good as the features they use. Redis serves as a real-time feature store, feeding ML models fresh, relevant data the moment it's generated.

That means better fraud predictions, faster decision-making, and fewer false positives. And because Redis delivers a sub-millisecond latency, there’s no delay between data being generated and being used.

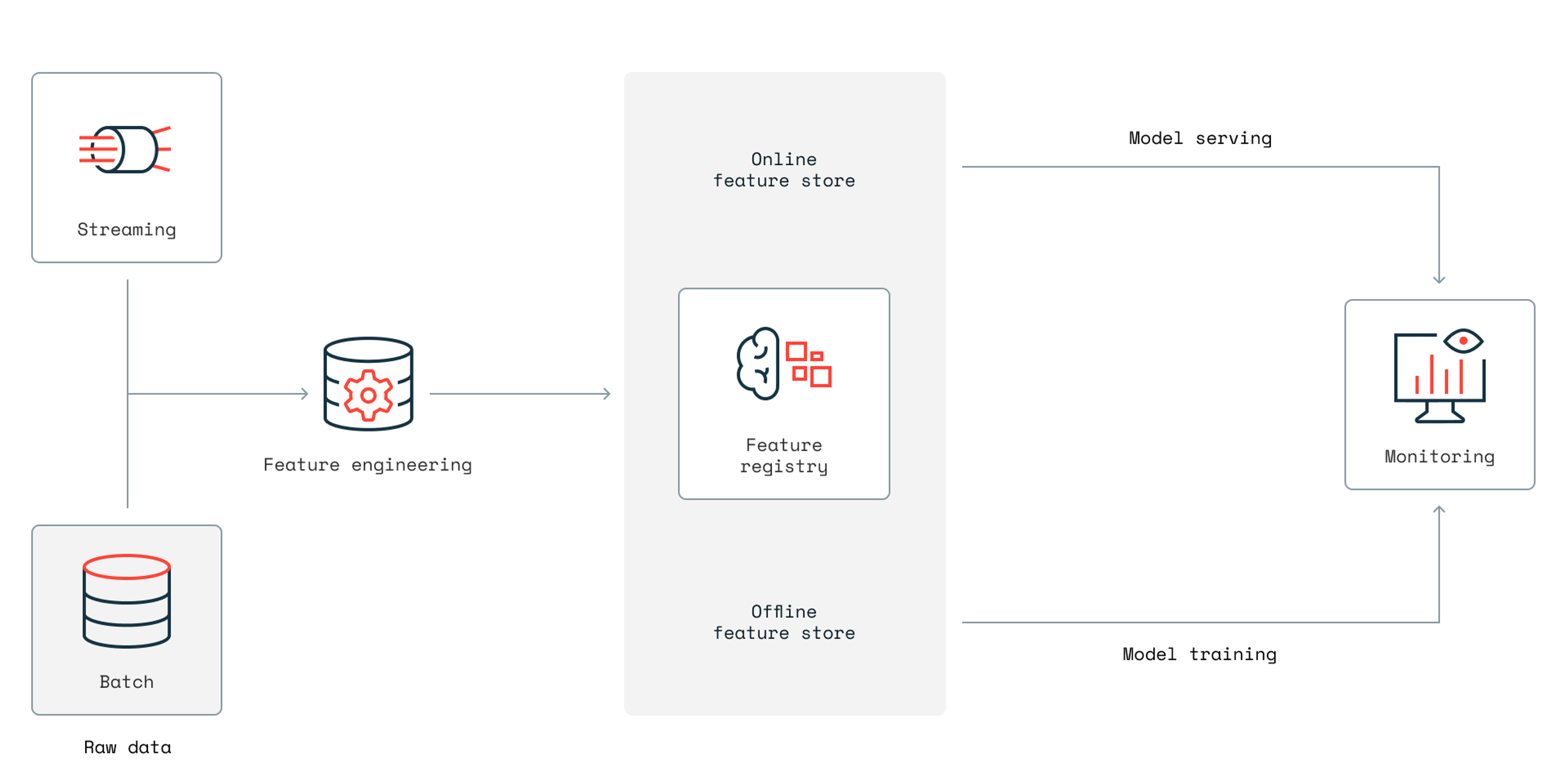

Here’s how it works

- Raw transaction and behavioral data is ingestedData is continuously collected from both batch systems (e.g., nightly reconciliations, historical account activity) and real-time streams (e.g., transaction events, login attempts, session activity, device metadata).

- Fraud-specific feature engineering pipelines are appliedThese pipelines process raw inputs into meaningful fraud signals—such as transaction frequency, velocity (e.g., transactions per minute), device changes, geolocation anomalies, login success/failure patterns, and prior fraud scores.

- Features are stored in offline and online feature stores, synched through a feature registry

- The offline store (e.g., data lake or warehouse) is used for model training and batch analysis.

- The online feature store (e.g., Redis) holds the most recent features for low-latency inference, synced through a central feature registry to ensure consistency across environments.

- During live inference, models fetch real-time features As each transaction or user action occurs, the fraud detection system retrieves relevant features, like recent IP addresses, spending habits, and location patterns—from the online store to instantly score the event for risk.

- The system monitors for drift and performance degradation Monitoring tools track changes in feature distributions (e.g., a shift in login locations or transaction amounts) and model outputs to detect fraudster adaptation and make sure detection quality remains high over time.

Session tracking to detect unusual behavior as it happens

Session data is one of the most valuable early signals for detecting fraud—often surfacing suspicious behavior before a transaction even occurs. Redis excels at tracking session activity with sub-millisecond latency and high throughput, making it ideal for monitoring user behavior patterns in real time across millions of active sessions.

With Redis, financial institutions can capture and update key session-level signals such as:

- IP address changes during a session

- Device fingerprint mismatches or new device usage

- Geolocation drift based on IP or GPS

- Behavioral anomalies like sudden navigation changes, rapid click patterns, or access from multiple geographies within short timeframes

Each user session can be represented as a Redis hash or JSON object that can be updated in real time as new events come in—whether from login flows, UI actions, or background telemetry.

Probabilistic data structures for fraud approximation

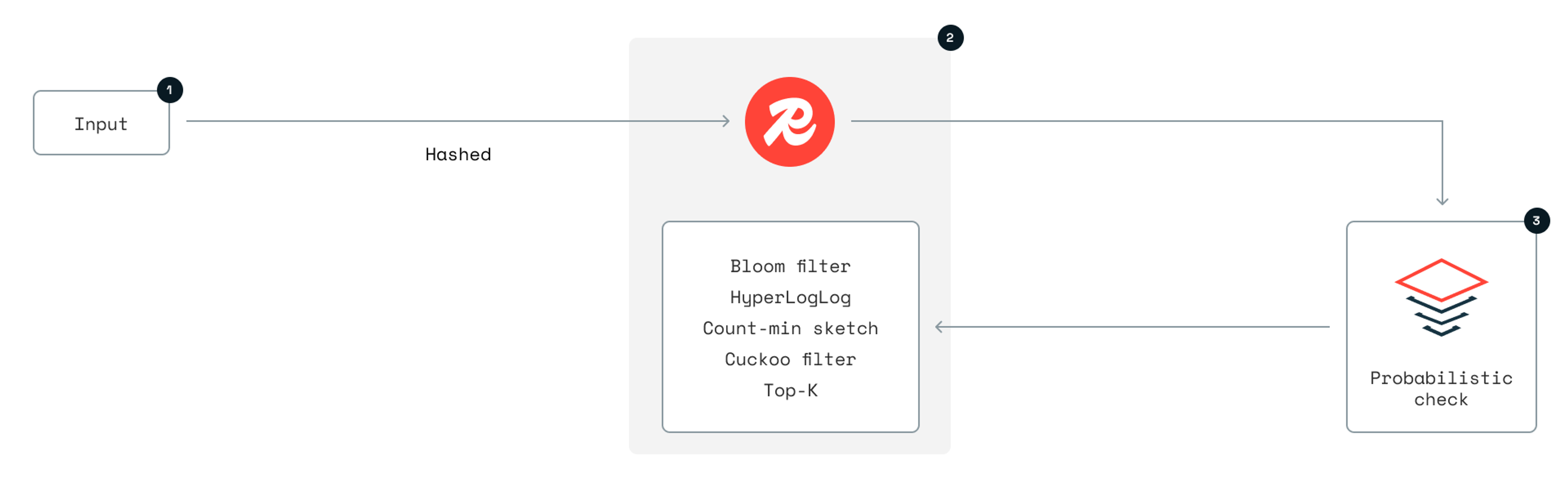

Sometimes you don’t need perfect accuracy—you just need fast, smart approximations. That’s where Redis’ probabilistic data structures come in.

Redis probabilistic data types offer fast, memory-efficient ways to estimate values like uniqueness, frequency, and membership—making them ideal for detecting patterns at a massive scale. They efficiently summarize large volumes of data by hashing inputs into compact representations. Instead of storing every individual event or value, these structures maintain statistical estimates over subsets of data, enabling fast queries with minimal memory use.

These tools trade precision for speed, making them perfect for fast fraud approximations that complement deeper detection strategies.

Financial teams can use these tools to find duplicate transactions, track unusual spikes, and check against known fraud signatures. This provides a lightweight, fast layer to find suspicious patterns without adding performance overhead, before more detailed analysis is needed.

Here’s how it works

- User and system events stream in (login attempts, transactions, account updates, etc.)

- Redis hashes these inputs like IP addresses, device IDs, and card numbers into compact representations—storing them in memory-efficient structures optimized for fast estimation.

- These probabilistic data types enable real-time fraud signals at scale:

- Bloom Filters—Check if an IP, device, or email has been seen before. Example: Is this IP address part of our list of known safe devices?

- HyperLogLog—Estimate unique users or devices over time to spot anomalies. Example: We usually see 10k unique logins per hour—now it’s 100k.

- Count-Min Sketch—Track how often events occur to detect abusive behavior. Example: This user has attempted 50 logins in 5 minutes.

- Cuckoo Filters—Similar to Bloom Filters, but allow deletions—ideal for dynamic allowlists or blocklists. Example: Remove a trusted device after it’s flagged as compromised.

Built for high throughput and low latency—always

Fraud doesn’t take breaks, and neither can your fraud detection systems. An outage or drop in performance can lead to a significant impact on your business.

Redis delivers sub-millisecond latency—even during high-stakes surges like payroll runs or flash sales.

Redis supports active-active deployments. This means that fraud detection stays fast, available, and consistent across global data centers. This is important for organizations that work in many regions and time zones..

How it works for businesses like yours

- Simility by PayPal: Uses Redis to process billions of transactions daily, enabling real-time fraud detection with high-speed data ingestion and analytics.

- One of the top 5 U.S. banks slashed fraud-related losses by millions—by turning Redis into a real-time fraud brain. With Redis as their feature store, they sped up model inference by 60X, catching fraud before it could escalate.

Want to see how teams stop fraud in real-time? Watch this 25-min session to learn how Redis powers real-time detection in production.

The bottom line

Fraud moves fast. Legacy technologies don’t. As the cost and complexity of fraud grows, financial institutions are shifting to real-time, intelligent detection systems that can spot and respond to suspicious activity before damage is done.

Redis helps make that possible. Whether acting as a low-latency feature store, powering session monitoring, or applying probabilistic data structures for fraud approximation, Redis delivers the speed, scalability, and flexibility needed to stop fraud at scale—without slowing down legitimate users.

With Redis, financial institutions can move faster than the fraudsters, protect their customers, and safeguard their bottom line. Interested in other ways leading financial institutions are building with Redis? Check out our blog.

Ready to outsmart fraud in real-time? Book a meeting or start building for free with Redis to stay ahead of tomorrow’s threats—today.